The Carrier Playbook

📰 The Report: Cargo theft rose 40% YoY in 2024, with 2025 on pace for another double-digit spike

🔎 The Reason: “Strategic theft” is up 1,475% since 2022, with fraud, spoofing, and global coordination leading the charge

💬 The Response: Carriers are tightening stop protocols, tracking assets end-to-end, and cashing in on insurance credits

Staying Safe

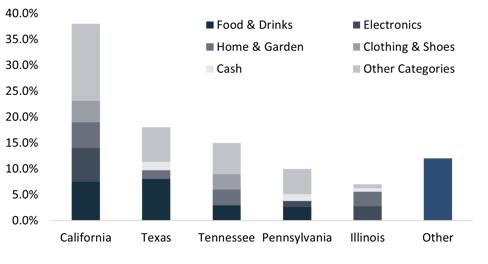

Cargo theft jumped 40% YoY in 2024, with the first half of 2025 signaling another double-digit climb. The average loss per incident is roughly $230,000, a hit that can erase margins for a quarter if you’re running tight. Risk is national but concentrated: California, Texas, Tennessee, Pennsylvania, and Illinois account for 88% of reported incidents. Most thefts involve trucks (79%), and a significant portion (41%) happens in transit, not at yards — pushing risk onto the first leg after pickup.

Cargo Theft by State and Commodity

Evolving Methods

Cargo theft is also becoming more advanced with “strategic theft” skyrocketing 1,475% since 2022. Fraudsters impersonate carriers or brokers, re-broker loads to unsuspecting drivers, and divert cargo or payment. Fraud is further enabled by business email compromise attacks that hijack load-planning threads, allowing thieves to insert fake contact info, reroute shipments, or alter instructions mid-stream. Dark web toolkits now include stolen ELD data, geofence overrides, and lists of unsecured distribution centers. These networks span 32 countries, making the threat coordinated, scalable, and hard to trace.

Staying Safe

Thieves often camp out the shipping facilities and target the first stop. So instruct drivers to avoid stopping for the first 200 miles when possible and to use well-lit, reputable truck stops or secure parking with on-site staff if necessary. Go full-stack on tracking. Attach GPS not just to the power unit and trailer, but also to high-value freight. Set geofences for immediate alerts on unauthorized movement, separation, or extended dwell and escalate with dispatch callouts. Capitalize on insurance credits. Many insurers offer 10–15% premium reductions for fleets using smart locks, live GPS, and anti-theft sensors. These savings multiply when applied across an entire fleet — and can fund further protection.

Share Your Thoughts